FIN 3301, Financial Management 1

Course Learning Outcomes for Unit V Upon completion of this unit, students should be able to:

4. Apply measures of risk in financial analysis. 4.1 Discuss whether investing in a specific company is a good financial decision.

6. Evaluate stock and bond valuation.

6.1 Research stock information for a chosen company. 6.2 Analyze recent stock activity for a chosen company. 6.3 Compare the stock valuation of two similar companies.

Required Unit Resources Chapter 11: Securities and Markets Chapter 12: Financial Return and Risk Concepts Unit Lesson In this unit, we will study the securities and markets and the concept of financial return. We will evaluate a public offering and learn about the functions of investment bankers. Further, we will assess the characteristics of primary and secondary markets and the role of ethics in securities transactions. Finally, we will explore the expected return on a portfolio of securities and explain the application of the CAPM (capital asset pricing model). Companies can raise capital through securities markets. The company can issue debt obligations as bonds or equity in the form of common or preferred stock. Financial markets exist to act as intermediaries between the companies that issue securities to raise capital and investors with capital they are willing to invest (Burton et al., 2015). The stock or bond of the company, once it is issued, can be traded in organized markets. The following sections discuss securities in various types of financial markets and the means of evaluating the risk associated with securities.

UNIT V STUDY GUIDE Securities and Markets and Financial Return

FIN 3301, Financial Management 2

UNIT x STUDY GUIDE Title

Financial Securities and Markets A company wanting to raise capital by issuing securities for trading in a public market has to follow a series of procedures. The company registers the security with the Securities and Exchange Commission (SEC) and has to comply with certain rules intended to protect investors. The issuer also has to prepare a prospectus describing the company and the risks associated with the security (Madura, 2008). Once the SEC grants approval for trading, the security can be issued to the public. The process is referred to as going public because the public then has the ability to purchase and sell debt and equity securities. The primary securities market is where a company makes its initial public offering (IPO) (Burton et al., 2015). To enter a primary securities market, companies use an underwriter to help the company determine the price that should be charged for a security, which is known as book building (Madura, 2008). The underwriter or a group of underwriters that form a syndicate attempts to maintain price stability for the shares of a new company after they are issued by buying and selling shares of the stock after the IPO date. In many cases, the underwriter has an overallotment option with the issuer that allows the underwriter to purchase as much as 15% more of the company’s shares. For example, if the price of the shares declines after the IPO, the underwriter can purchase additional shares at the offer price to increase the market price of the shares. A significant cost exists for companies when issuing securities. The costs include the legal and accounting fees necessary to prepare the Securities and Exchange Commission (SEC) registration and the prospectus. As mentioned above, the company also has to engage the services of an underwriter to bring the debt or equity issue to market. The underwriter generally buys the issue from the company and sells it in the market, charging as much as a 7% spread for the underwriting services (Brigham & Ehrhardt, 2008). For example, a company issuing 9 million shares at $23 a share would have to pay the underwriter $1.61 a share, which would cost the company $14.49 million in underwriting fees. A secondary securities market is where the previously issued securities of a company are sold after the IPO. The financial markets are divided by the different types of securities that are sold in the markets. For example, debt securities that have a maturity of less than one year are traded in the money market while debt securities that have a maturity of greater than one year are traded in the capital markets. A secondary market can also consist of a physical market such as the New York Stock Exchange (NYSE) or a computer network such as the National Associate of Securities Dealers Automated Quotations (NASDAQ) (Brigham & Ehrhardt, 2008). Some stock exchanges such as the NYSE and the NASDAQ have requirements that companies have to meet to be listed in the exchange. Security transactions involve the buying and selling of debt or equity securities by individuals and organizations such as mutual funds or pension funds. The security transactions between buyers and sellers in secondary markets rely on brokers and market makers. The broker generally takes the order for a transaction from a buyer or seller and passes the order to a market maker who arranges and executes the trade (Burton, et al., 2015). For example, a buyer may want to purchase 100 shares of Exxon at a specific price. The buyer communicates the order to a broker who then places the order with a market maker who specialized in trading Exxon shares. If the market maker can find a party with 100 shares of Exxon willing to sell at the specified price, the transaction takes place. Transactions can take place through outcry auction in which buyers and sellers verbally provide information to the market makers about willingness to buy or sell at a specified price or electronically through a computer network (Brigham & Ehrhardt, 2008, p. 23). For example, a buyer is willing to purchase 100 shares of AT&T at $32.29. In an outcry market, the dealer shouts out the bid to

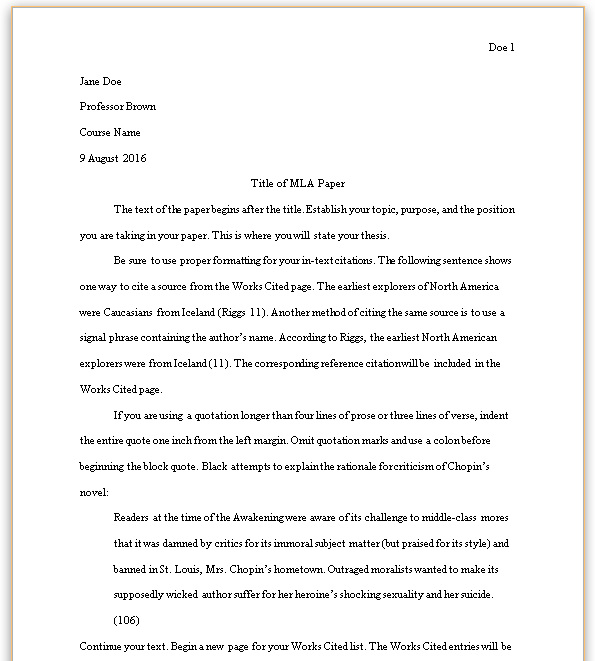

There are several steps a company must take to be publicly traded. (Rawpixelimages, n.d.)

FIN 3301, Financial Management 3

UNIT x STUDY GUIDE Title

determine if any sellers are willing to sell at the stated price. In an electronic computer network, the bid price for AT&T would be entered into the system to determine if any sellers are willing to meet the price. An important securities market is the Over-the-Counter (OTC) market. The OTC market consists of a network of securities dealers trading stocks that are not listed in an official stock exchange such as the NYSE or NASDAQ (Burton et al., 2015). The trading system in the OTC market is automated through the electronic network of dealers. The OTC market can include unusual types of securities such as derivatives that do not qualify for listing on other exchanges. In addition, it operates without the supervision of an exchange, which suggests that securities traded in the OTC market bear a higher degree of risk than securities traded in organized exchanges.

Financial Return and Risk The general performance of a securities market can be determined by the security market index, which is a share price index based on the average price for a basket of shares traded in the market (Coyle, 2002). By monitoring the performance of the index over time, it is possible to determine the general direction of the basket of shares or of a market as whole. For example, the Dow Jones Industrial Average (DJIA) contains 30 stocks traded on the NYSE, which only reflects a portion of the NYSE. A change up or down in the DJIA is only indicative of a change in the 30 stocks, although it does suggest that the NYSE as a whole is rising or falling. In contrast, the Russell 3000 index contains 3,000 stocks and is a good indicator of the performance of the U.S. market as a whole because the index includes so many stocks. An additional use of the stock market index is to compare the returns of a single stock against the market as a whole, which can be helpful for assessing whether the single stock is underperforming or outperforming the market. The stock index is also useful for computing the beta of a stock, which is a measure of the systematic risk associated with a stock that reflects the sensitivity of the price of the stock to the market as a whole (Madura, 2008). For example, a stock with a beta of 1.5 is expected to rise or fall at a rate 50% greater than the market as a whole.

All portfolios have some tradeoff between risk and return, with reduced risk associated with low returns while high risk is associated with higher returns. When determining the risk and return estimate for a portfolio, the approach focuses on the current and historic return of stocks as well as historic risk. Beta is an indicator of the historic risk of a stock because it has higher volatility. The use of alpha is an important component of portfolio management, with alpha as the risk-adjusted relative return of stocks in the portfolio compared to a benchmark market index (Michaud & Michaud, 2008). In theory, portfolios with a higher level of historical risk as determined by factors such as beta should provide returns in excess of the market to justify the higher risk. When constructing a portfolio, a risk premium is added to the historic index benchmark return to determine the expected return for the portfolio.

Developing a portfolio of stocks is based on the efficient market hypothesis, which presumes that investors are rational actors that price securities in a rational manner based on the available information (Madura, 2008). The hypothesis assumes that all investors have access to the same information about the company. The implications of the hypothesis are that stocks are always in equilibrium and it is impossible for a portfolio to outperform the market (Brigham & Ehrhardt, 2008 2015). In practice, however, investors are not aware of all information with the price of stocks subject to uncertainty. An example is the IPO price of Google at $85 a share, with investors uncertain if the price was too high or too low. The market price of the stock grew to over $1,000 in several years as some of the uncertainty about the company’s future prospects was resolved. Market actors are also sometimes irrational, relying on emotion to make stock decisions.

All stocks have a balance between risk and return. (Wattanapichayakul, n.d.)

FIN 3301, Financial Management 4

UNIT x STUDY GUIDE Title

The capital asset pricing model (CAPM) is a means that investors can use to determine the systematic risk of individual companies and the return that an investor with an efficient portfolio should expect (Coyle, 2002). The CAPM formula is: Re = Rf + (Rm – Rf)β

• Re is the expected rate of return, • Rf is the risk-free rate of return, • Rm is the expected rate of return for the market, and • β is the beta of the stock.

The risk-free rate of return is generally the rate of return for a Treasury note while the rate of return for the market depends on the return expected from a benchmark index. The combined weighted expected rates of return of stock in a portfolio reflect the expected return for the portfolio. The CAPM model suggests that investors should be concerned only by non-diversifiable risk or the stand-alone risk of the stock. Despite the popularity of the CAPM model for portfolio construction, some research has determined that beta does not have any relationship to the return of a stock (Brigham & Ehrhardt, 2008). In summary, we learned about the securities and markets and financial return. We studied the process of a public offering and learned about the functions of investment bankers. Further, we assessed the characteristics of primary and secondary markets. Finally, we explored the expected return on a portfolio of securities and explained the application of the CAPM.

References Brigham, E. F., & Ehrhardt, M. C. (2008). Financial management: Theory and practice. Thomson South-

Western. Burton, M., Nesiba, R. F., & Brown, B. (2015). An introduction to financial markets and institutions. Routledge. Coyle, B. (2002). Equity finance. Financial World. Madura, J. (2008). Financial institutions and markets. Thomson South-Western. Michaud, R. O., & Michaud, R. O. (2008). Efficient asset management: A practical guide to stock portfolio

optimization and asset allocation. Oxford University Press. Rawpixelimages. (n.d.). ID 56294205 [Image]. Dreamstime. https://www.dreamstime.com/stock-photo-stock-

exchange-market-trading-concepts-image56294205 Wattanapichayakul, W. (n.d.). ID 28635533 [Image]. Dreamstime. https://www.dreamstime.com/stock-photos-

high-risk-high-return-image28635533 Suggested Unit Resources In order to access the following resource, click the link below. In this unit, you learned about financial markets. The 8-minute video below gives a great overview of this topic. You are encouraged to watch it to learn more. MoneyWeek. (2011, April 1). An introduction to financial markets [Video]. Cielo24.

https://c24.page/6u9xtzy7s5ycbgnyhgng3m6kny A transcript and closed captioning are available once you access the video.

FIN 3301, Financial Management 5

UNIT x STUDY GUIDE Title

Learning Activities (Nongraded) Nongraded Learning Activities are provided to aid students in their course of study. You do not have to submit them. If you have questions, contact your instructor for further guidance and information. How well do you know the unit material? Take the Unit V Knowledge Check Quiz to find out! (PDF of Unit V Knowledge Check Quiz)